In today’s interconnected digital landscape, countless businesses and professionals engage globally and conduct business daily. Online payment platforms are crucial for facilitating cross-border transactions. They are widely utilized by marketplaces, networks, businesses, and professionals to perform online transactions worldwide, allowing them to pay and receive payments as if they were local seamlessly.

Payoneer is a leading financial services company specializing in online money transfers, digital payments, and working capital solutions. It connects and supports millions of businesses and professionals across over 200 countries and territories, fostering global growth. Payoneer’s cross-border payments platform empowers businesses, online sellers, and freelancers worldwide by offering fast, flexible, secure, and cost-effective payment solutions.

Advantages of Having a Payoneer Account

- Cost-Effective International Transactions: Payoneer significantly reduces fees associated with cross-border payments compared to traditional banks. Users can often send money internationally without incurring fees, especially when transferring between Payoneer accounts, making it a budget-friendly option for businesses and freelancers.

- Multi-Currency Accounts: With Payoneer, users can hold and manage funds in multiple currencies, including USD, EUR, GBP, and JPY. This feature allows businesses to conduct transactions in local currencies, avoiding unfavorable exchange rates and simplifying financial management.

- Fast Transfers: Payoneer facilitates quick transactions, with many transfers completed within hours. This speed is crucial for businesses that need immediate access to their funds for operational expenses or investments.

- Global Reach: Payoneer supports payments in over 200 countries, allowing users to send and receive money from clients and partners worldwide. This extensive network makes it easier for freelancers and businesses to operate on a global scale.

- Secure Transactions: Payoneer employs advanced security measures, including two-factor authentication and data encryption, ensuring that users’ financial information is protected against fraud and unauthorized access.

- Integration with Marketplaces: Payoneer seamlessly connects with popular freelance platforms such as Upwork and Fiverr, enabling users to receive payments directly from clients without hassle.

- Prepaid Debit Card: Account holders receive a prepaid debit card that can be used for online purchases or ATM withdrawals globally, providing easy access to funds whenever needed.

- User-Friendly Interface: The platform is designed to be intuitive and easy to navigate, making it accessible even for those new to online finance management.

These advantages make Payoneer a compelling choice for anyone looking to simplify their international payment processes while maximizing efficiency and cost savings.

How to Register for Payoneer

- Legal Documents (Citizenship, Passport or Driving License)

- Correct contact address.

- Valid email and phone number

- You should be approved by the Payoneer Team.

Get a Free Payoneer Account and a MasterCard

- Follow the below steps to claim your free account and a Mastercard.

- To claim your 25$ reward, click below the image or click this link here

- Click the above image or Click here, and you will be directed to a new screen. Click on the “Sign-Up & Earn $25*” button.

- You will get the following screen as in Figure 01. Fill the Contact details carefully and click on the Next button.

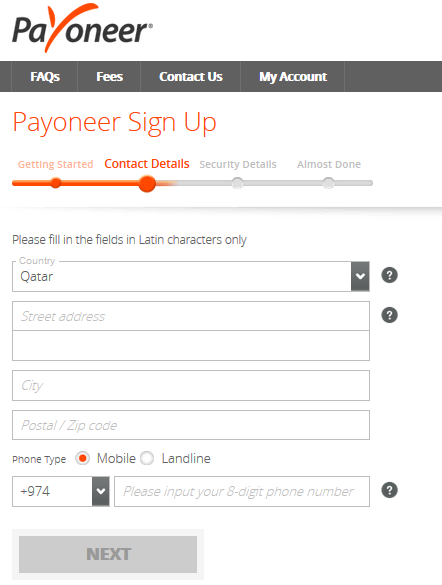

- You will see below the screen as in Figure 02. You will be prompted to enter the country, address, postal code, and phone number. Click the Next button.

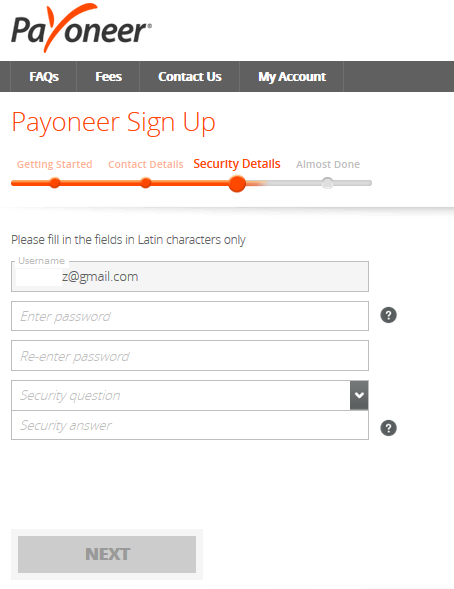

- You will see below the screen as in Figure 03. Fill the security details carefully and click on the Next button.

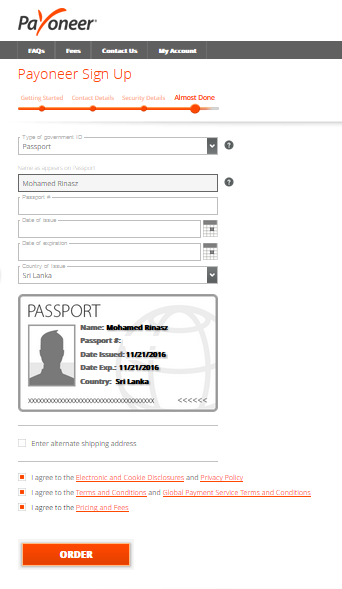

- Next, you will be requested to select one of the document types to verify yourself i.e. Driving License, Passport, or National ID. You may select which is appropriate.

- In a later stage, you will need to submit a scanned copy of this selected document to activate your Payoneer card.

- You will also have an option to provide an alternative delivery address.

- Finally, in this step, you need to accept Payoneer terms and conditions before you click on the Order button.

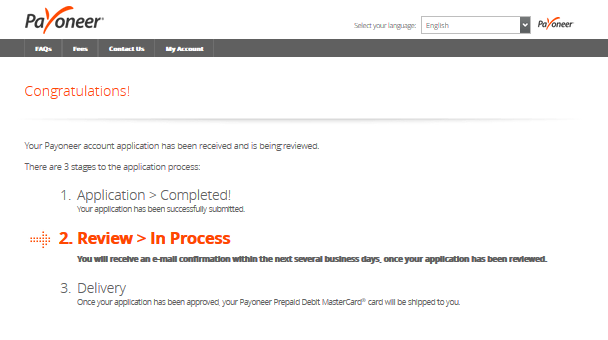

- If all your steps are successful, you will receive the below message.

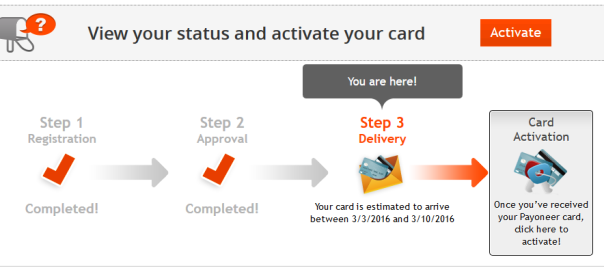

- There are three steps in this entire process, out of which you just completed the first i.e. Application.

- The other two steps are Review (that is reviewing your application for approval) and Delivery (delivering your Payoneer card). You will receive an email to the above address you provided when providing contact details explaining all three steps.

- The important point, you will also receive an Account reference number with the above email, which is required to use when you contact regarding your account to Payoneer.

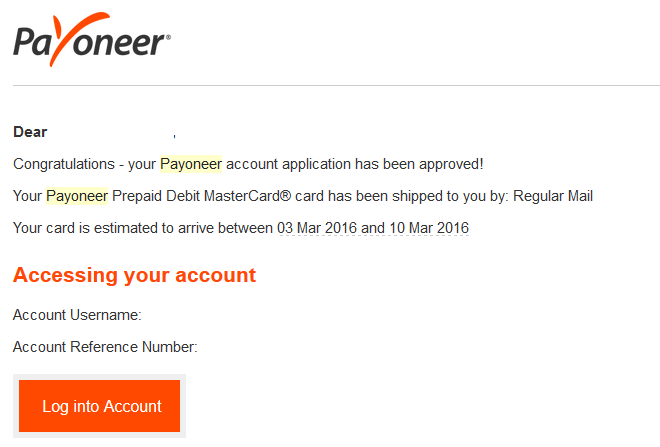

- If your application is successful and approved, you will get an email confirming as shown in the following Figure 06.

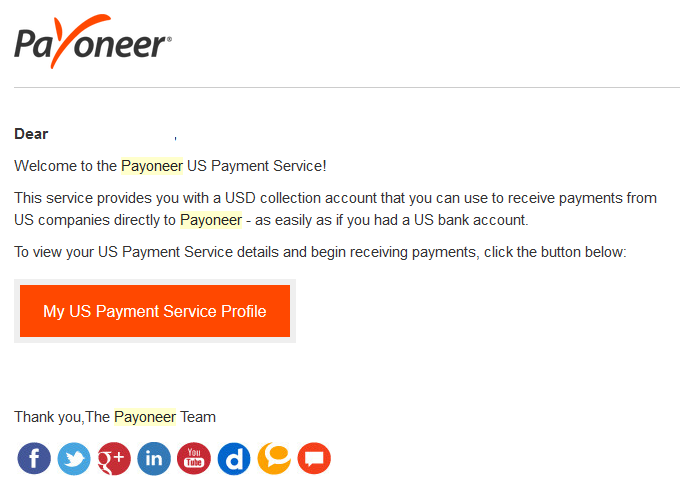

- Finally, you will also receive a welcome message as in Figure 07 below

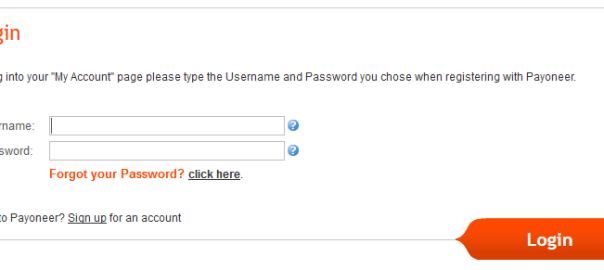

- You can click on the “My US Payment Service Profile” button. You will be prompted to fill in your user credentials to log in to your account. Use the email and password you provided when you entered security details during registration.

- You can see an activate button in front of the text “View your status and activate your card”. Click on the Activate button and you will notice below the screen as in Figure 09.

- Congratulations! It’s completed. Wait until they deliver your card.

- That’s it. I will explain how to activate your card in my next article. There are a lot more details about it and we will discuss them in detail.

Disclaimer: This article contains affiliate links. If you choose to sign up through these links, we may receive a small commission at no additional cost to you. This helps support our blog and allows us to continue providing valuable content. Thank you for your support!

Share your thoughts and suggestions on the above article. Kindly note that all comments are moderated according to our comment policy, and your email address will NOT be published.

[…] Explore our earlier article on the Payoneer Card. […]